Determined

This series uses the Social Determinants of Health as a foundational framework and guideposts to bring you stories of how the COVID-19 crisis has impacted some of our African American communities.Matthew Murphy needed to clear his head. The week before the response to the COVID-19 pandemic hit Charlottesville, the 43-year old took a job as a housing navigator at The Haven day shelter. All day every day, he has worked the phones, trying to find housing for people without any. The Haven finally has funding to pay for peoples’ first month’s rent and security deposits. Now, they have a different problem: landlords.

The Haven in downtown Charlottesville.

Credit: Lorenzo Dickerson

“You see, but don’t hear people’s reservations,” said Murphy about his conversations with landlords. “They’re never going to say, ‘No, we won’t do that for these people’ or ‘We don’t want to rent to these people.’ But that’s basically what they’re saying. We’re seeing it.”

For years, just one block away at the Downtown Job Center, Murphy helped many similar people try to find work. There too, when he’d call, employers found excuses not to hire people or not to pay them close to a living wage. “It’s frustrating,” said Murphy. “You see what’s out there. You see what could be.”

After weeks of this landlord rejection, which has largely played out along racially-woven economic lines — almost all his clients are Black — Murphy went for a drive. He drove through primarily Black areas of the city — Friendship Court, Westhaven, 10th and Page. It was quiet. Not many people were out. Then, he drove down Wertland Street, the University of Virginia’s transition into commercial businesses and student housing. Tons of people were outside, he said, jogging, hanging out in yards. Then, he drove home. He lives off East Rio Road, down the road from the new Lochlyn Hill subdivision, where homes have been selling for between $500,000 and $830,000.

The Lochlyn Hill subdivision, which straddles the border between Charlottesville and Albemarle County.

Credit: Lorenzo Dickerson

“There are these beautiful, modern eco-friendly, million-dollar houses with no curtains,” he said, comparing them to homes in Friendship Court and Westhaven, both built on the heel of local urban renewal projects in the 1960s and ’70s. “It’s hard to explain, but you can feel the difference. Imagine sitting in this 3,000- or 4,000-square-foot house with 6-foot windows and sun flooding into the room. You’ve got a yard with a fence, and the kids are outside playing.” He paused. “I drove though Westhaven, and was like, damn, do they even get sunlight?”

“No property in this subdivision”

Study after study has shown that quality affordable housing is one of the most vital social determinants of health. It directly affects what happens to people at every stage of life: their educational outcomes, the types of jobs they get and how much they pay, their ability to access and afford quality food, their physical and mental health, their children’s safety and future.

Charlottesville has been in an affordable housing crisis for years now, made more imperative because of longstanding racial and economic systems of segregation that have denied successful life outcomes to many generations of Black residents while gifting many white residents with wide-ranging structural and policy supports.

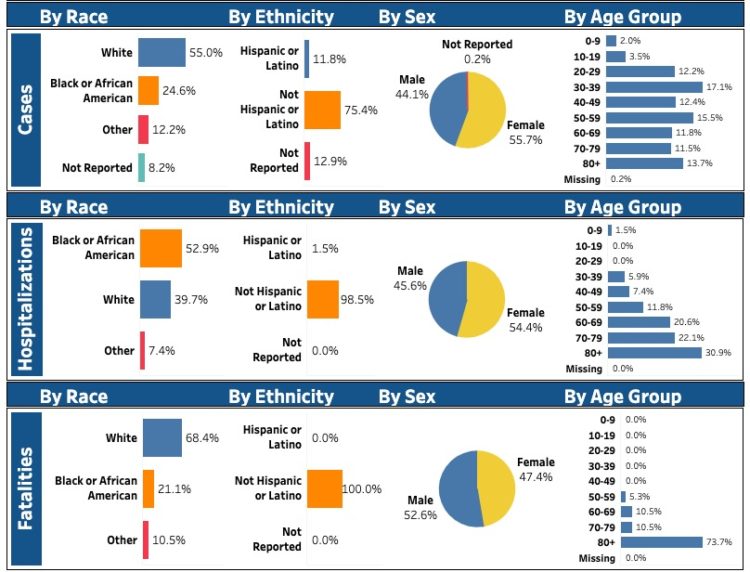

Credit: Virginia Department of Health

This correlation between housing and health is most glaringly evident right now, as Black residents make up 12.4% of the health district’s population, but 26.5% of the 429 total people with COVID-19 and 21% of those it has killed. White residents are being infected and dying at disproportionately smaller rates. This is no anomaly. Pre-COVID, throughout the entire health district — which includes the city of Charlottesville and the counties of Albemarle, Fluvanna, Greene, Louisa and Nelson — life expectancy for Black residents was 74.7 years White residents lived to an average of 81.2 years old — 6.5 years longer.

On a more local level, this disparity becomes more stark. In the Locust Grove and Martha Jefferson neighborhoods, where 90% of the population is white, life expectancy is 81.3 years. In the Venable and Rugby neighborhoods, where 82% of the population is white, life expectancy is 82.6 years. Compare this to the Fifeville, Forest Hills and Orangedale neighborhoods, where 57% of the population is Black, life expectancy is 76.4 years — 6.2 years less than white residents a mile away. In the Ridge Street area, which includes the Sixth Street and South First Street public housing neighborhoods, where 40% of the population is Black, life expectancy is 73.7 years — 8.9 years less.

The Martha Jefferson neighborhood.

Credit: Jordy Yager/Mapping Cville

These primarily white neighborhoods have existed for more than a century. Earlier this month, the American Political Science Review published a paper showing that, throughout the country, the more white a city’s population is, the more likely it is to restrict land use. Charlottesville’s predominantly white neighborhoods have almost all contained racist covenants within their housing deeds, ensuring variations of “No property in this subdivision is to be sold to any person not of the Caucasian race.” And when, in 1968, the Fair Housing Act rendered these illegal, the racial segregation tools shifted to using restrictive single-family zoning, which today prevents more people from living on 70% of the city’s residential-zoned land.

“I know firsthand what it feels like to lose everything”

Yolunda Harrell

Credit: Lorenzo Dickerson

Yolunda Harrell is currently the CEO of the New Hill Development Corp., but on September 11, 2001, she was working for a major airline. After the terror attacks, she immediately found herself among tens of thousands of people in the industry without a job. She’d never before been unemployed.

“I didn’t know how to deal with that at all,” she said. “I was not financially prepared.”

She didn’t have any savings. She hadn’t invested in her company’s 401(k) retirement plan. “I just didn’t take all of those things into consideration because no one had ever explained it to me,” she said. “As a result, I learned a lot of hard painful lessons.”

She lost nearly everything, and set out to not just rebuild, but also learn more about financial health. By 2008, when the financial crisis hit the U.S. and she was working for a major hotel chain, she was in better shape.

“By that point, I had personally put money away and knew that if I did lose my job, no big deal, I could find a job and find a way to survive, versus the last time,” said Harrell.

But whereas in 2001 Harrell was just taking care of herself, in 2008 she was managing dozens of staff. “I had to think about how is this going to play out in their life,” she said. “What was this going to mean for them — if they need insulin and their insurance goes away? What are the local resources that could potentially help this person?”

She looked back on 2001 and found inspiration. “Had I not experienced that hardship, I don’t know that I would have had that level of thought for my team members,” she said. “I’d like to believe I would, but when you know what it’s like to be evicted and have cars repossessed, you don’t wish that on anybody.”

Like most crises, the one in 2008 hit Black homeowners harder than white ones. In the preceding years, Black borrowers were 30% more likely than white ones to receive higher-cost subprime loans. And in 2008, when the housing bubble burst, Black borrowers were 76% more likely than white borrowers to lose their home. What’s more is that in the following years, between 2009-2012, Black households that did hold onto their homes lost an estimated $194 billion in indirect capital as adjacent properties depreciated in value.

In 1970, less than two years after the 1968 Fair Housing Act’s enactment, after generations of racist housing policy designed to prevent Black homeownership, 42% of Black households nationally owned their homes. Today, 50 years later, the current homeownership rate for Black households is 44% — in 2004, it spiked to 49.4% — whereas now, 73.7% of white households own their home. Furthermore, a 2017 analysis found that 19.3% of Black prospective homebuyers had loans denied, compared to 7.9% of white ones.

Now, with more Americans on unemployment than ever before and the economy in complete disarray, African Americans are being the hardest hit yet again. Harrell looks back on her own education and how it’s helped her weather storms. She wants to help others prepare for the next one.

“Crisis is going to come back again, whether it’s this or something else,” she said. “So let’s get people to better manage their position, no matter where they are on the economic spectrum.” Harrell and local affordable housing advocates are closely watching for the nearest sign of market collapse. This time, they said, they’re better equipped. This time, they have a plan.

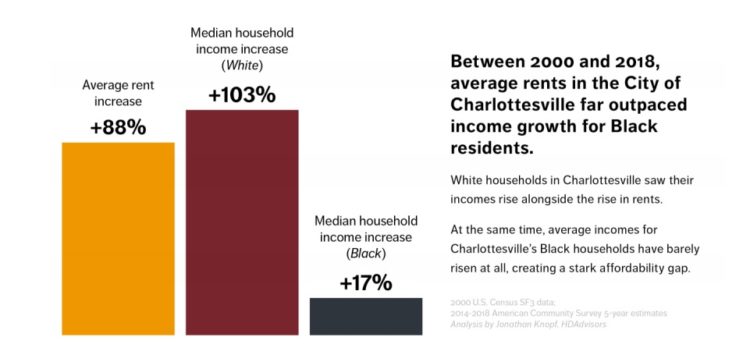

“It impacts your worldview”

In March, the Charlottesville Low Income Housing Coalition (CLIHC) released a much-awaited 100-page report extensively detailing the region’s history of racist housing policy, connecting it directly to today’s affordable housing crisis. Between 2000-2018, the report found, the average cost of rent in Charlottesville increased by 88%. But, over this same period, the median income for white households increased by 103%, allowing them to keep pace with rising costs of living, the median income for Black households increased just 17%. Much of this is due to racially segregated and biased job sectors.

The report also contains the results of perhaps the most comprehensive survey on gentrification and displacement ever conducted within Charlottesville’s Black communities. One of the 129 survey respondents noted this income and cost-of-living divide, saying: “Sixty years later we are still being treated like we’re prisoners, but our only crime is that we didn’t invest our money, because we didn’t have any money to invest.” Another respondent called attention to the illusory signs of gentrification: “It looks more diverse, but in fact families of color are getting pushed out. [It’s a] cloak and dagger process of actually becoming less diverse.” And one resident took note of the surrounding landscape and the messages it sends: “There used to be Black-owned businesses. Bike trails don’t benefit us.”

Lacking affordable housing options, renters and homeowners alike are forced to move. From 2000-2018, the rate of Black homeownership in the city fell by 24% (from 982 to 745), meaning that one in four Black homeowners either moved or lost their home, while white homeownership increased by 20% (from 5,739 to 6,906).

The report also shows how this housing disparity affects people’s financial health — 9% of Black city residents make more than $100,000, whereas 88% of white residents make that much. As with all things, the COVID-19 pandemic has exacerbated this reality. Since Gov. Ralph Northam declared a state of emergency in March, at least 147 homes have been sold in the city — 64 of those, or 42.9%, sold for more than $400,000. Thirteen properties, or 8.8%, sold for more than $900,000 — 10 of these are in areas that were restricted for the first half of their history by racist covenants, including the most expensive: a $2.6 million, five-bedroom, 7,652 square-foot house in Meadowbrook Hills. Today, these houses are restricted by R-1 single-family zoning, and as assessments continue to balloon, so does their value.

“From racial covenants to single-family zoning to small area plans, Charlottesville has always found ways to keep wealth and power in the hands of a largely white minority of wealthy residents,” the CLIHC report states.

Homeownership is the primary U.S. tool for accumulating wealth, and a major reason behind the vast racial wealth disparity. In 2016, the federal reserve found that median wealth for Black households was $17,100, whereas for white households it was $171,000.

During a pandemic, Matthew Murphy said the effects of this wealth disparity are obvious. Many white residents are able to work from home during a stay-at-home order — keeping themselves safe and financially healthy. Or they’re able to temporarily reduce their work hours, while having savings to rely on. Or they simply don’t have to worry about mortgage or rent payments. And there’s a deeper, psychological effect too, he said.

“If you’ve got 300-plus years of people never having the pressure of coming up with money to pay rent every month, and never not knowing if they’re going to make it or not — never feeling that, never breathing that, never seeing it in their parents faces, never having to put your kids through that — it impacts your worldview,” said Murphy.

“Don’t be afraid of that”

Yolunda Harrell stands in the Starr Hill neighborhood, which contains a parcel the New Hill Development Corp. developed a small area plan for.

Credit: Lorenzo Dickerson

Growing up in Alabama, Harrell said her mother stressed to her the importance of volunteering — that, despite living in public housing themselves, they should always look for ways to help those less fortunate. It was part of what drove her to start New Hill, an African American community development initiative focused on building “pathways of upward mobility in a city where wealth and prosperity abounds yet is secluded in plain sight.”

Harrell has structured New Hill — an homage to the Vinegar Hill neighborhood where Black businesses and dozens of Black-owned homes thrived and were destroyed by white city officials — around three pillars: financial literacy and coaching, economic development and affordable housing. Each of these, said Harrell, is deeply tied to every other social determinant of health.

“Wealth building is not just about money,” she said. “Wealth building is also about connection building. It’s about emotional health. It’s about physical health. It’s hard to focus on those things when you don’t have capital resources.”

With that in mind, and an eye towards impending foreclosures or home sales driven by financial hardship, New Hill is turning its attention to preservation — specifically, finding ways to prevent Black-owned homes from “getting gobbled up by those who have the means,” said Harrell. If a Black homeowner, particularly a senior homeowner, wants to sell their home, and if their family doesn’t want it, Harrell is creating ways to ensure it stays Black-owned, while also guaranteeing that the seller doesn’t lose money in the sale. “How do we get them to be willing to sell that property to a nonprofit that then sells it back to a first-time homebuyer?” she said, adding that the approach needs to intentionally focus on African American residents. “Don’t be afraid of that.”

Sunshine Mathon is the executive director of Piedmont Housing Alliance, which manages and oversees more than 600 units of housing in Charlottesville and the surrounding counties reserved explicitly for low-income residents. After the 2008 crisis, he said, the cost of land and homes plummeted, and he realized it would have been the perfect time for affordable housing advocates to buy properties and create a land bank. Now, he’s trying to do exactly that.

“We’re exploring every possibility to enable investment, whether direct or indirect, on behalf of communities to ensure affordable opportunities in the future,” said Mathon.

A land bank is a smart idea, Harrell said. Less clear is where the initial capital to purchase properties will come from and who controls the properties once they’ve been purchased. Whatever the design though, it needs to be cooperative, she said.

“I think right now we’re at the point where people are realizing that collaboration is gonna be key to long term success,” said Harrell.

In April, Mathon wrote an op-ed imploring people, who can afford it, to donate their stimulus checks to frontline organizations helping people, saying that if they did not, they would actually be harming themselves and their own families because of how interconnected society is.

“As COVID-19 so clearly illustrates, by simply hunkering down and shaking our heads at the injustice, we actually perpetuate the condition, compromising our own health and safety in the long run,” Mathon wrote. “We have never, as a society, had such a universal opportunity to honestly calculate the impact of our choices, to align our instinct for self-preservation with our moral conviction.”

This is what Yolunda Harrell’s husband, Quinton Harrell, the chair of the Charlottesville Regional Chamber of Commerce’s Minority Business Alliance, calls the “opportunity cost.” And it’s why many housing advocates argue that adding housing stock at higher price points, above $500,000, does not deter the wealthy from buying homes in the $300,000 price range, which they have been doing, taking them away from people with lower incomes. But rather, advocates say, it just entices more wealthy people to buy here and furthers existing inequities.

“A decision to fund beautification in predominantly affluent white neighborhoods rather than invest in basic amenities in predominantly Black neighborhoods is a racist choice,” states the CLIHC report. “Given the demonstrated correlation of economic and racial inequity, choosing to invest in middle-income housing over low-income housing means choosing to continue displacing Black people from Charlottesville.”

Credit: Lorenzo Dickerson

Elaine Poon, a lead author of the report and managing attorney for Legal Aid Justice Center’s Charlottesville office, pointed to the dozens of recommendations it details towards creating more equity: to better fund public housing, the city’s voucher program and the Charlottesville Affordable Housing Fund; to provide more tax relief for low-wealth homeowners; and to use taxes to disincentivize gentrification, to name a few. But more than anything, Poon said, she hopes the city listens to the voices of the historically ignored communities in creating future plans.

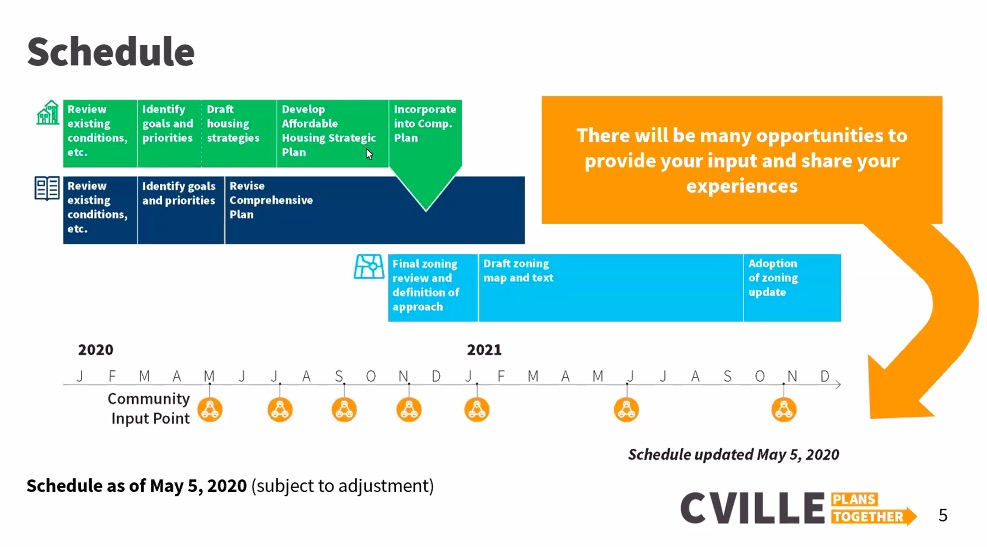

Six months ago, the city selected the firm Rhodeside and Harwell Inc. to lead a complete rewrite of the city’s Comprehensive Plan, affordable housing strategy and zoning rules. So far, the group has held dozens of meetings with area stakeholders, and recently launched a series of webinars to get further community engagement. By the end of 2020, it plans to unveil a new affordable housing strategy, and by March 2021, a revised Comprehensive Plan, which will then direct a rewrite of the city’s zoning rules by the end of 2021.

In its first webinar, RHI shared a slide deck with about 45 participants. “Land use planning and zoning have historically been used to create and maintain racial segregation,” stated one slide. Another read: “The growth of the housing supply is restricted by the high proportion of residential areas zoned for low-density housing.” It was the first time a consultant hired by the city had stated so frankly a racist and inequitable past that many have talked about for generations.

Yolunda Harrell is hopeful, too. Economic connectivity is starting to happen, she said, and the more it does, the more crises will be able to be weathered. Last year, with $500,000 from the city, New Hill waded into the collaborative environment, holding focus groups and community engagement sessions to complete a 77-page small area plan for the 47-acre Starr Hill neighborhood, prioritizing African American culture and community desires.

“Collectively, we can accomplish a lot more than if we’re all fighting individual battles on our own,” she said. “It has to be very intentional. We have to look at the bigger picture and connect these dots.”

It’s Harrell’s hope that the plan, which centers Black-owned and Black-run resources, can be a pillar of these citywide overhauls and reimaginings, but that it won’t end there.

“I think we can start to work at it from all fronts, understanding that sometimes relationships and social capital are what help you get to that financial capital,” said Harrell. “Once you get there, you can then help others and it becomes a ripple effect around the community, and we can start to see significant changes in the way we eat, the way we sleep, the way we interact with each other, the way we support one another.”